Why the Economy is Stable Despite the Public Health Emergency

The stock market continues to react to coronavirus headlines on a daily basis - with both negative and positive market swings. As the death toll rises (primarily in China at the moment), the fact that this is a human tragedy and not just an economic or financial one should not be diminished.

However, from an investment perspective, it's important to not over-react to daily headlines, especially ones that are extremely uncertain. While the impact on the Chinese and global economies won't be known for a long time, recent data suggest that the U.S. economy is still quite healthy. For diversified investors, a stable and growing economy is the foundation of long-term portfolio returns.

Last Friday's jobs report provided further evidence that this is the case. 225,000 non-farm jobs were added in January which significantly exceeded economists' expectations. In total, about 22 million new jobs have been created since 2010 and, even after a decade of growth, new jobs are still being added at a pace of over 2 million per year.

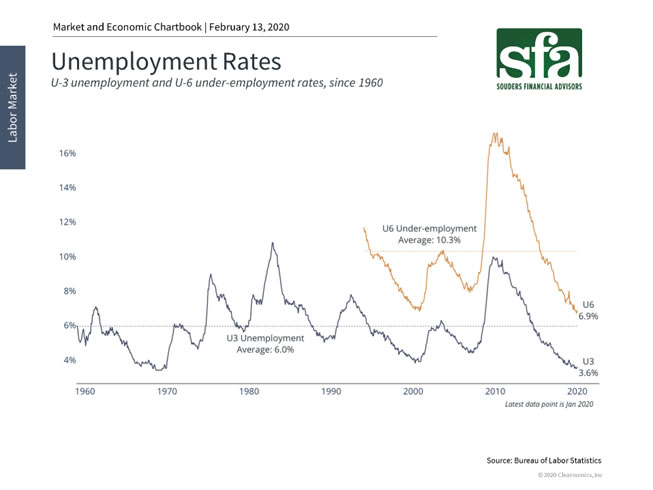

The unemployment rate did increase slightly to 3.6% - still nearly the lowest in half a century (see graph below)- but only did so because more Americans re-entered the labor force after being on the sidelines. The evidence of this is a rising "labor force participation rate" which measures the proportion of Americans working or looking for work. This percentage plummeted after the financial crisis and has until recently been flat since 2013.

For many investors and economists, the labor force participation rate is a key metric for determining how long this cycle might last. This is because an economy that runs out of workers would eventually overheat - either growth would slow, wages and inflation would rise, or both. The fact that Americans who have been on the sidelines are re-entering the workforce is a sign that perhaps we are not at "full employment" just yet.

What this mean for investors, amid global public health concerns, is that the underlying foundation of diversified portfolios - a stable economy - is still intact. While we might debate the specific rate at which the economy can grow, the ultimate toll of the coronavirus, and how these factors might impact corporate profits in 2020, it's clear that there are still few signs of a recession. Given the circumstances, it's important for investors to stay disciplined in their portfolios in order to achieve their financial goals.