A Lesson From History

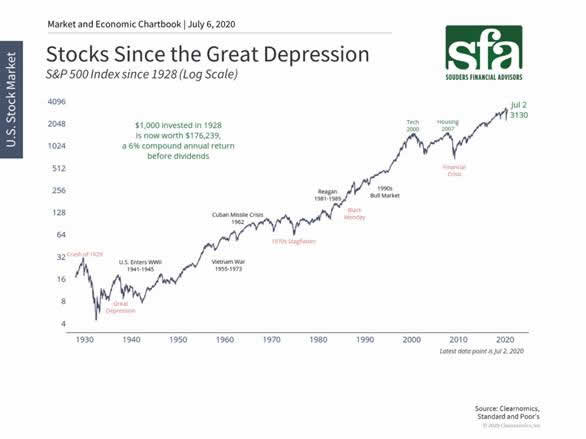

With COVID-19 cases surging in some states and uncertainty abound, sometimes it can be best to take a look at the past to guide investor's moving forward. Throughout history, there have always been reasons to not invest. The chart below includes a World War, the Great Depression, multiple other expensive and traumatic military conflicts, a dozen or so recessions and the current global pandemic. However, $1,000 invested in the S&P 500 in 1928 would be worth $169,428 today which would give an investor an annualized 6% compound return before dividends .

Looks pretty good, right? As an investor, it is sometimes a helpful exercise to put yourself in the shoes of an investor in various moments in history knowing what we know now and think as to how you might feel. It may be similar to how you are feeling today. We asked ourselves the same question and came up with the following principles that we believe would help an investor at any point in this chart:

Perspective: The chart going back to 1928 is an extreme example of perspective. But the two main things you will notice is that the market grew a considerable amount since then and that it was not a straight ride upwards. By keeping perspective during difficult times, we can remember that enduring short-term market fluctuations is the price we pay to earn the historically positive long-term returns that market has always provided.

Discipline: Whether you are a retired investor or a young investor, discipline is a key principle during times of uncertainty. While discipline may also be the hardest principle to maintain as our emotions can take over when extreme volatility and panic spread throughout the market, we would argue it may be the most important. And while it is okay to get spooked by large market movements, having discipline means having the ability/courage to continue with your investment plan, whether it is as an example, continue contributing to your 401(k) throughout periods of extreme volatility, or rebalance your portfolio to add more stocks during a volatile market. In investing, sometimes doing the right thing feels emotionally counter-intuitive.

Diversification: Don't put all of your eggs in one basket. Having a well-diversified portfolio that is built for your investment objective is always key to success. Events may turn the tide of different sectors in our economy and make or break various companies, so it is important to always be mindful of how exposed your portfolio is to one asset class/security. Diversifying with non-correlated investments has historically proven to provide better risk/adjusted returns.