Market Update: Through Q1 2022

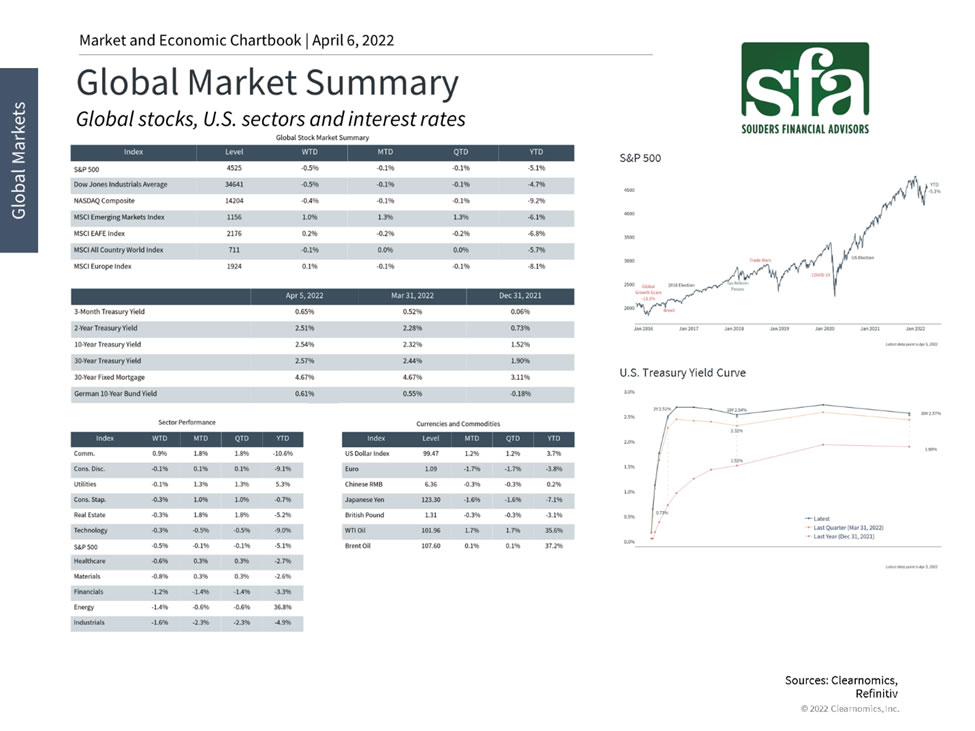

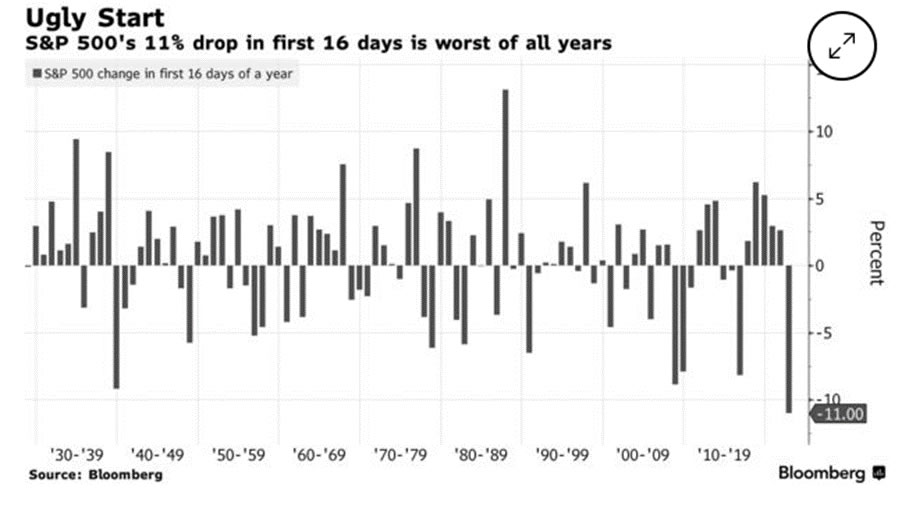

In the first quarter of 2022, investors felt the return of stock market volatility. Headlines ranging from COVID variants, increased inflation, Fed Reserve rate hikes, and the war in Ukraine have all caused violent swings in the stock market. The S&P 500 saw one of the worst starts to a new year as it dropped 11% in the first 16 days of the new year (source: Bloomberg News, 2022) as seen in the chart below. The market has since played a game of ping-pong with violent down trends, followed by reprieve in recovery rallies. The S&P 500 saw a total draw down in the quarter of -14% but finished down -4.6%.

Another story to watch in the stock market is the role reversal of growth and value stocks. For the past few years, growth stocks have far outpaced value stocks in their market performance. Led by the high-flying technology sector, valuations of many growth companies were relying on a mixture of market exuberance and low-interest rates—which leads to higher discounted cash-flow valuations. The sudden change of market sentiment and the Federal Reserve’s hawkish policy of raising interest rates has caused markets to favor value stocks in the short term. Value stocks can be characterized by their business sectors, which tend to have consistent cash flows and pay dividends to their shareholders. These sectors include financials, industrials, energy, and consumer staples. In the first quarter of 2022, Morningstar’s US Value Index rose 2.3%, while their US Growth index lost 12%.

The bond market also provided some interesting headlines in the past quarter. With on-going inflation continuing from the second half of 2021, the Federal Reserve committed to raising rates by .25% in their mid-March meeting. According to NASDAQ, it is believed that the markets are pricing in another eight to nine .25% moves in 2022. These anticipated moves have been reflected in bond prices, which as a general rule decline in their marketable value as current interest rates rise. The first quarter wasn’t kind to the bond market as the US Aggregate Bond Index was down -6.01%.

Looking forward after a rough quarter, it is as important now as ever to remain patient and confident in a properly allocated portfolio. We encourage our clients to contact us with questions on their investment portfolios and to discuss any changes taking place with your financial plan.