Market Update: 6/1/2020

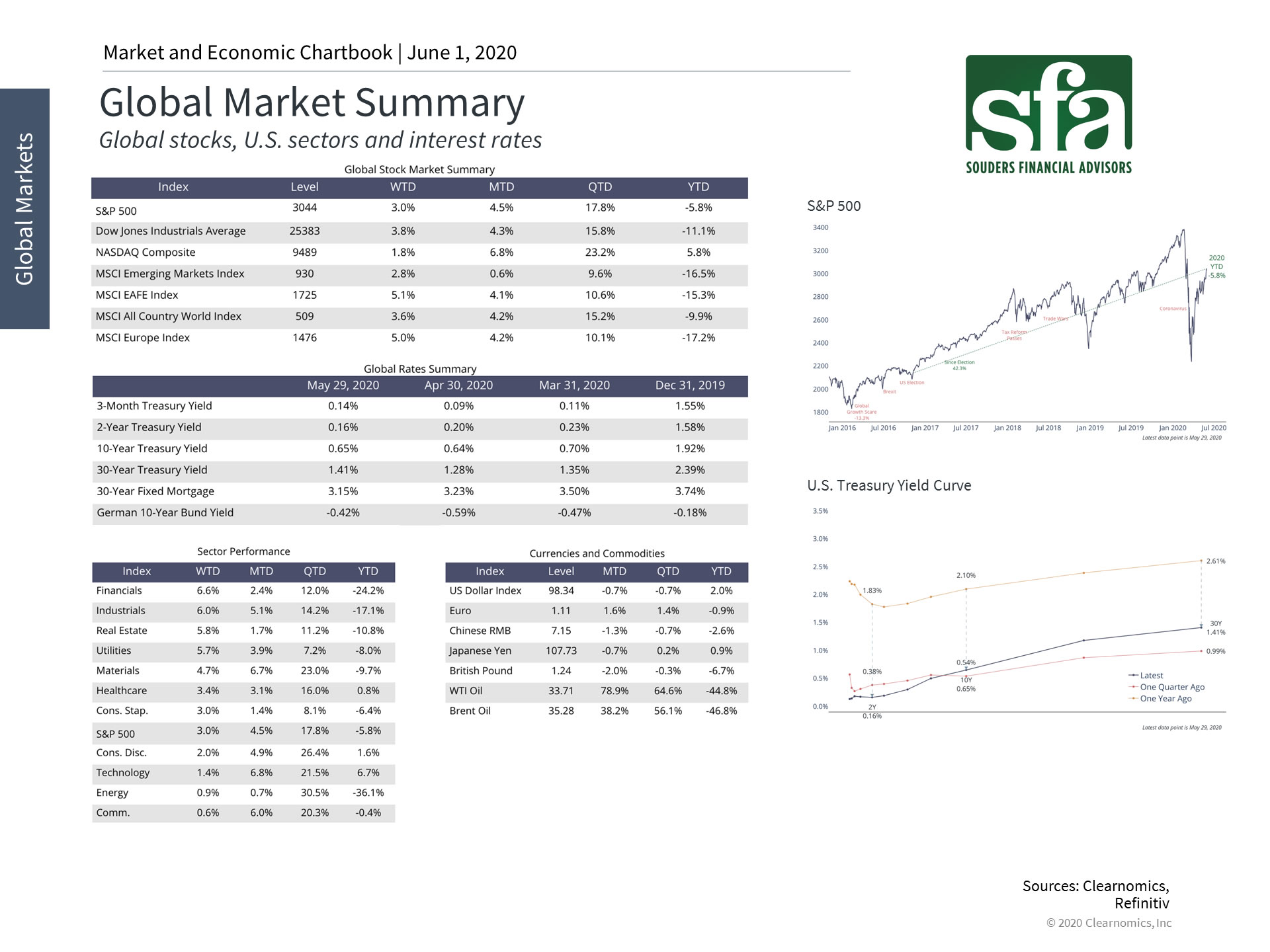

After a sharp rebound in April, off of the March lows, May continued to show strength in a stock market rally as the S&P 500 was up 4.5% month over month. May's rally was largely fueled by the positive news of progressing vaccine trials and hopes for a fast-tracked vaccine, which could be available by the end of 2020 in a best-case scenario. This news coupled with the reopening of many states' economies fueled optimism that the US economy is bottoming and starting recover from a deep decline in economic activity.

Despite the recent rally, economists measured the first quarter drop in GDP at -4.8%. In order for the US to be in recession, there must be two successive quarters of negative GDP. Many economists believe second quarter GDP will be negative and that we are currently in a recession. The stock market, however, is mostly forward looking and pricing tomorrows economic conditions. It seems the market is pricing in an economic recovery, but there are many major issues standing in the way to a recovery including record unemployment, decreases in CapEx spending from businesses and the uncertainty of a second major wave of COVID-19 this fall/winter.

It is becoming rather clear that the economic recovery will likely depend on the containment of COVID-19, whether it be by continued social distancing, a treatment/vaccine or a combination of both, etc. it is also clear that the timing is simply unknown. But, while we have experienced an extremely scary and sad time in our lives and world history, we are confident that the American economy and our way of life will prevail. The advancements made by pharma companies in such short time, the pivoting of manufacturers from their normal products to front line products like PPE or ventilators and the courage and reserve of our medical workers, first responders and essential business employees all speak to the reserve and resilience of our country.

We continue to monitor your portfolios with your investment goal(s) in mind. We encourage you to reach out to your advisor to review your portfolio or discuss any changes to your investment goal(s).