Q4 2021: Market Headwinds and Tailwinds

We hope that this message finds you well and that you enjoyed the summer. As we start the fourth quarter of 2021, we wanted to provide some brief commentary on the state of the stock market and the economy.

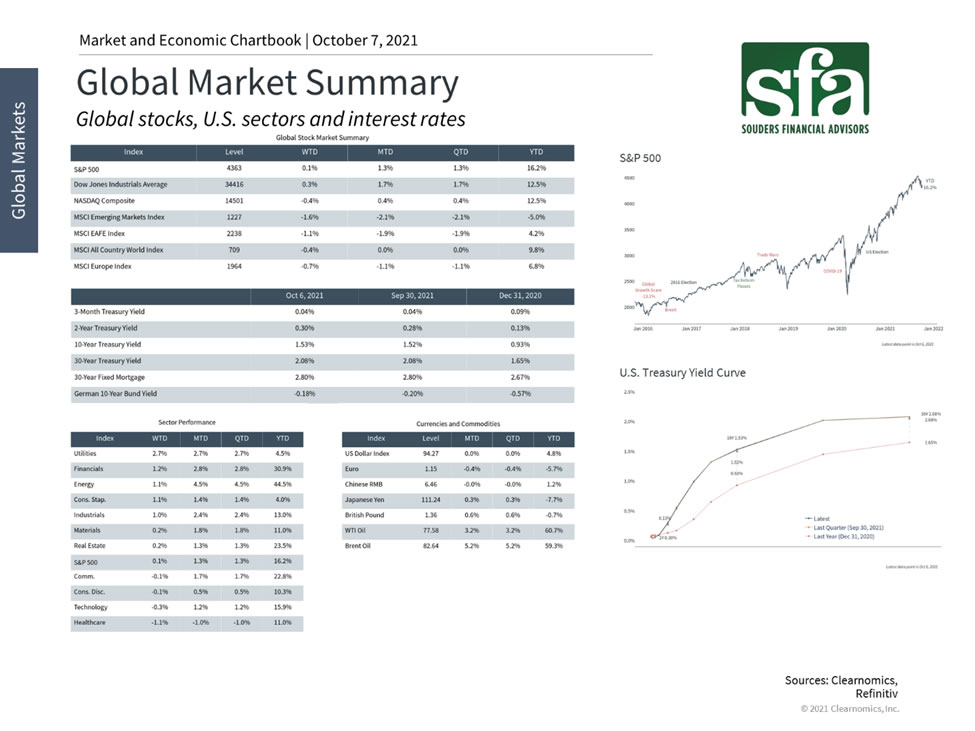

This year, there have been topics as far ranging as the presidential transition to the delta variant and Afghanistan. Yet, the S&P 500 gained nearly 16% with dividends this year through the end of the third quarter. The markets repeatedly show that those who stay disciplined and look past the daily headlines are often rewarded, regardless of how quickly market sentiment turns.

Today, the big issues that weigh on markets can seem nearly insurmountable, as they often do. The nature of the short recession last year, which only lasted two months, and the swift recovery have been unlike any cycle in history. This has made it difficult to measure and interpret traditional economic data such as inflation and growth rates. Even when the data return to pre-pandemic levels, the year-over-year percentage changes can be extraordinarily large.

On top of measurement and interpretation issues, there have also been real structural challenges, most notably around global supply chains. Much of this is rooted in the on-going disruptions in manufacturing and shipping that have affected industries from semiconductors to construction materials. While it's reasonable to expect that these issues will be resolved, trying to predict the exact timing is difficult if not impossible. The computer chip shortage is still a major problem while lumber prices have already fallen significantly.

These problems not only affect the performance of companies, stocks and sectors, but they are also an input into monetary and fiscal policies. One of the Fed's key mandates is to keep prices stable which will require reducing asset purchases and eventually hiking rates. At the same time, Congress and the White House are actively pursuing new spending measures, which will also impact tax policy. While these headlines naturally garner investor attention, seasoned investors have been through many such periods over the past two decades. In almost all cases, the best course of action was to stick to appropriately-tailored investment plans.

Perhaps then the biggest shift in markets over the past several weeks is that interest rates have begun to rise after pausing for two quarters. This has put downward pressure on tech-related sectors, counter-balancing improvements in areas such as energy and financials which have benefited from these trends over the past year. Not only will interest rates likely climb further, but investors should continue to expect higher levels of volatility. Only at the end of the third quarter did the S&P 500 experience its first 5% pullback for the year. Such short-term pullbacks are normal for markets and investors should be comfortable with greater uncertainty in the months to come.

It's important to emphasize that this is all occurring against a backdrop of a strong economy and robust corporate profits - factors that do not depend on how investors feel. Ultimately, long-term investors ought to position themselves for years and decades, not days, weeks or months. By most measures, we are still early in the business cycle despite the shared feeling that the pandemic has lasted a lifetime already. Achieving financial goals requires true dedication and discipline, regardless of what markets are concerned about in the short run.

As always, do not hesitate to reach out to your advisor with any questions or concerns as it relates to your financial situation.