Market Update: Through Q4 2022

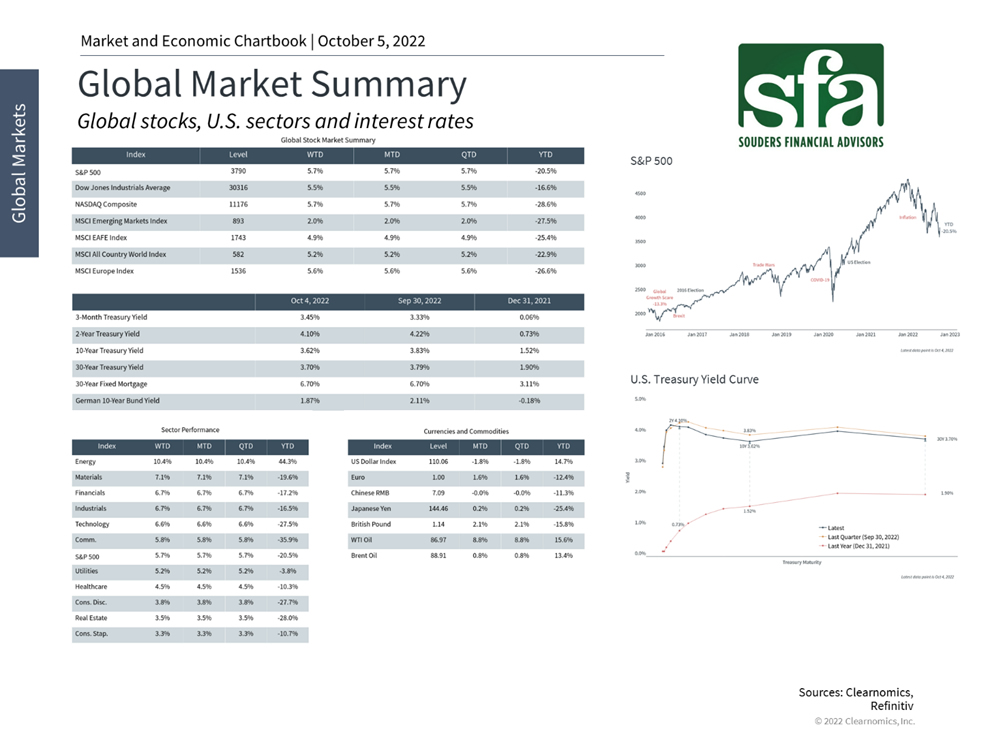

Investors have navigated a difficult market all year and the third quarter was no exception. All major indices ended the quarter in bear market territory with the S&P 500, Dow and Nasdaq declining 5.3%, 6.7%, and 4.1%, respectively, from July to September. With the dollar strengthening and the global economy slowing, the MSCI EAFE index of developed markets fell 10% over the same period in dollar terms, while the MSCI EM index of emerging markets pulled back 12.5%. Interest rates jumped with the 10-year Treasury yield climbing above 4% on an intra-day basis, the highest level since 2008. The challenges of persistently high inflation and slowing growth have continued to impact the expectations of both investors and policymakers.

As a new quarter begins, investors will continue to closely monitor inflation and the interest rate expectations that come along with it. Throw in an upcoming midterm election and a continued war abroad, and there are plenty of factors that may lead to market volatility for the foreseeable future.

In times like these, investors would naturally prefer to wait until it feels comfortable to invest, and even experienced investors may wonder if markets will ever turn around. This is why it's important to remind ourselves that while bear markets are unpleasant, they also create opportunities for long-term investors. The valuations of major indices, sectors and styles are at their most attractive levels in years, and bond yields are finally at levels that can support portfolio income.

A key principle of investing is that achieving long-term returns doesn't just involve risk - it requires it. This is true whether markets are down due to the economy, geopolitics, a pandemic, or any of the hundreds of investor concerns over the past few decades. After all, if staying invested were easy, everyone would do it and there would be no opportunities at all. History shows that those investors who have the discipline and fortitude to handle market pullbacks are more often than not rewarded. So, for those focused on the rear-view mirror, the glass may seem half empty. For those focused on future recovery and growth, the glass is overflowing. Having the right mindset to overcome our own psychology has never mattered more.