2023 Markets: The Year in Review

After a dismal year in both stock and bond markets in 2022, almost every economist and financial pundit was forecasting a recession in 2023. The unprecedented (yes, this word is growing tiresome to us too) rate hikes along with the sharp market selloff, the economy was left on rocky ground starting 2023. Many experts questioned how the economy would react to such steep rate hikes, how it will affect inflation, the labor market, etc. All eyes were on the Federal Reserves' policy and economic data.

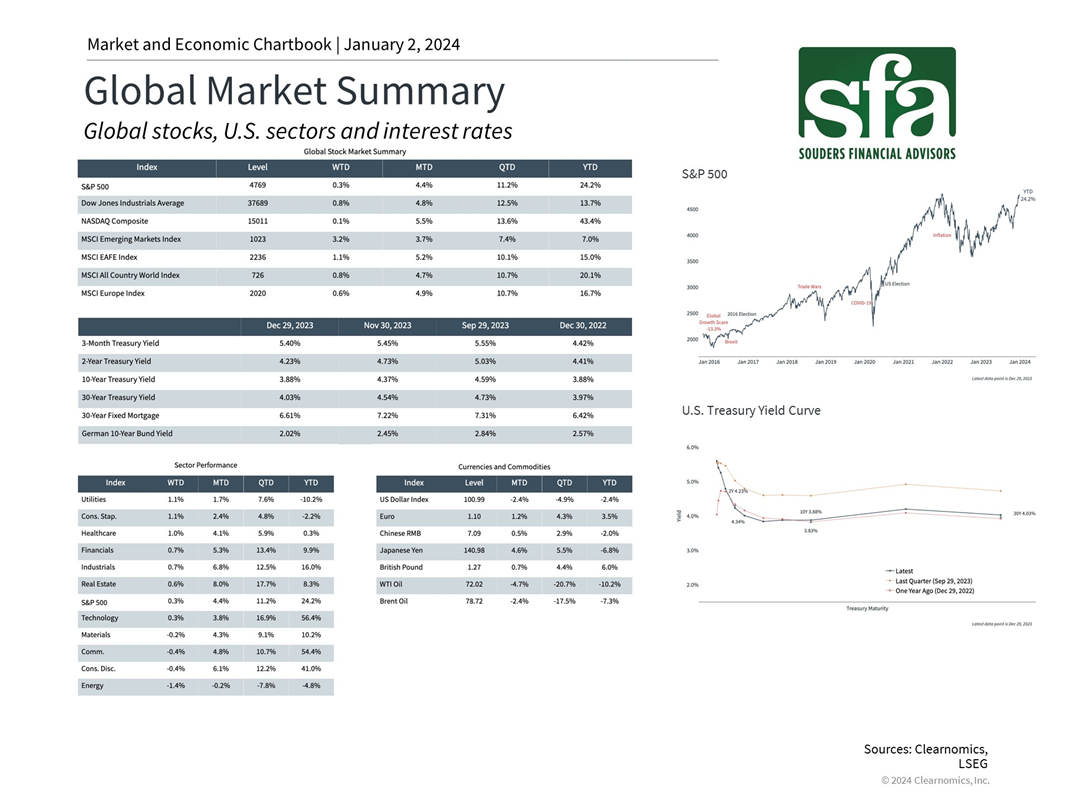

The first quarter of 2023 presented some interesting challenges, as cracks started to appear in the banking system. This caused the failure of a handful of mismanaged and poorly capitalized banks and sent some shocks through the market. As time passed, it was clear that this was not a systematic problem, but rather a few companies who did not manage their balance sheets adequately. What also became abundantly clear as 2023 progressed, was that the economy was more resilient than economists expected. Jobs data continued to be strong and projected a healthy labor market, and with every CPI and PCE reading, we saw inflation decrease closer to the Fed’s 2-3% long term target. It was not without its setbacks, as September and October provided volatile down-market days. This coincided with the 10-year treasury soaring above 5%. This was followed by a strong bond and stock rally in November which got the market back to its starting levels at the beginning of 2022. In mid-December, Federal Reserve Chairman Jerome Powell announced 3 expected rate cuts in 2024 dependent on data, which caused the market to have a nice “Santa Claus rally” with the S&P 500 closing up 24.20% and the Barclays Bond Aggregate up 5.65% for the year.

What to watch in 2024:

• Bonds can act like bonds again: As investors we own bonds for two primary reasons: 1.) diversification from stocks and 2.) income. After years of historical low yields, bond investors now enjoy yields of around 4% on the Barclays Bond Agg as we start 2024. This is up from around 2.10% at the beginning of 2021. In 2022, both stocks and bonds were negative. In 2023, bonds made a decent comeback. This year, eyes will be on the Federal Reserve to dictate where rates go. But bond investors can sit back and collect a nice stream of income as they watch.

• Slowing economic growth: The Federal Reserve mentioned in their December meeting that growth was slowing into the end of 2023. This caused a projection of three interest rate cuts for 2024. This projection is all based on data as the Fed walks a tightrope of not holding interest rates higher for too long, and while also keeping inflation at bay.

• Election Year: The 2024 presidential election is sure to make for an interesting year and will certainly dominate news headlines. While election years can produce volatile markets, historically the election outcome has little impact for long-term investors.

• Cash on the sidelines: Investors have enjoyed higher rates the past year by investing in money market funds. It's estimated that there is about $6 Trillion in money market funds. If rates move down, this mountain of cash might be seeking new opportunities which could have a positive influence on bond and stock markets.

*Note: all performance data referenced is from Morningstar